Michigan was one of multiple states that was included in Wednesday’s release of ALICE in the Crosscurrents: COVID and Financial Hardship, a report that highlights the segment of our population known as ALICE (Asset Limited, Income Constrained, Employed).

The research organization United For ALICE, using a new series of standardized measurements, partnered with United Way networks in 22 states to present a broad picture of financial insecurity in the U.S, drilling down to the county and municipal levels in each state.

We shared state and local information earlier this week – the research shows that 13% of households in both our six-county region and in the state live below the Federal Poverty Level, while another 26% struggle to make ends meet.

But what does the data tell us about the national landscape?

A panel of experts explored that topic Wednesday in a webinar, looking at how ALICE households have fared in the midst of competing economic forces such as job disruption, inflation, wage increases ad pandemic assistance.

The panel consisted of:

- Roger Millar, Secretary of Transportation, Washington State Department of Transportation

- Seth Colby, Tax Research and Planning Officer, the State of Hawaii

- Sue Gallagher, Chief Innovation Officer, Children’s Services Council of Broward County Florida

- Rissah Watkins, Director of Planning, Assessment, and Communication, Frederick County Health Department, Maryland

- Sherece West-Scantlebury, Ph.D., President and CEO, Winthrop Rockefeller Foundation (moderator)

Here are some of the highlights from that conversation:

- Across the United States, there are approximately 52.5 million working households that are struggling to make ends meet. The pandemic showed that ALICE workers were critical to keeping the economy running during times of crisis and beyond. ALICE workers helped us quarantine at home, supplying food and medicine, and helping to keep the economy running. They took risks to show up in person, and many of them were living in households that were struggling.

- During the pandemic, some positives happened such as increase in wages and unprecedented pandemic assistance. There were also negatives, including numerous job disruptions, job losses, and the onset of inflation. Many people were forced to move.

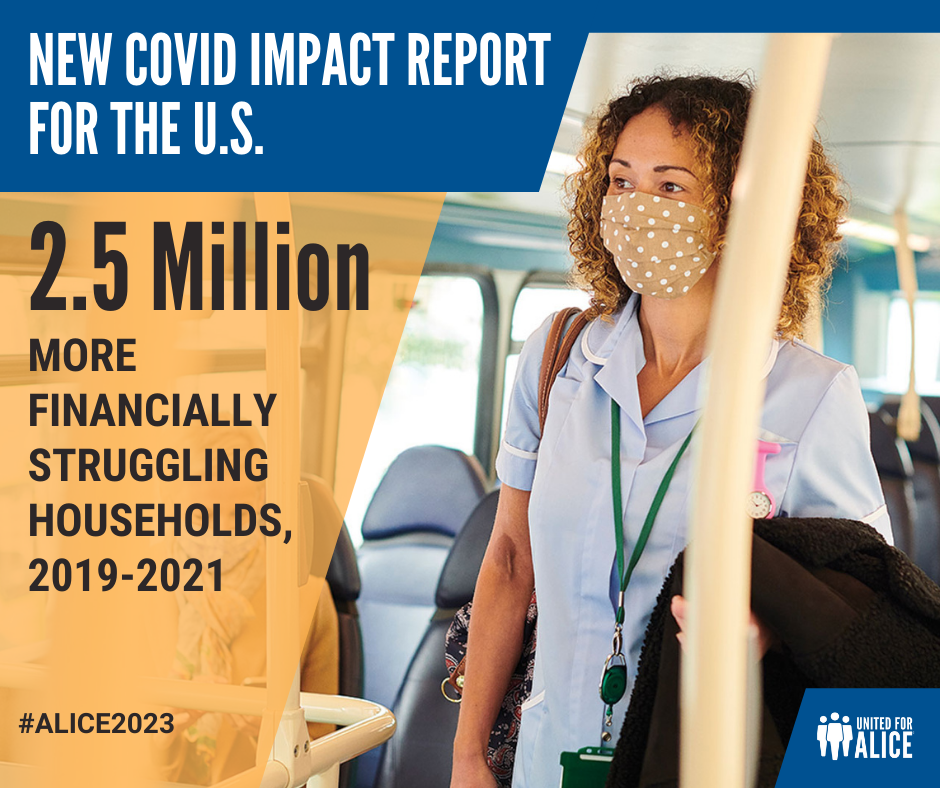

- The pandemic resulted in an increase in the total number of households below the ALICE Threshold to 41% of all U.S. households. In 2019, there were 49.8 million households below the ALICE threshold. In 2021, that number jumped to 52.5 million.

- There are ALICE households in every state, and at least one-third of households in every state don’t earn enough to afford the basics. The numbers range from 32% in Alaska to 52% Mississippi. Groups most affected by financial hardship are Black and Hispanics households, people under 25 and over 64, and single-parent households. Groups with the lowest rates of financial hardship are White, working age and married-parent households.

- Across the U.S., the most common jobs are ALICE. Sixty percent of the most common jobs pay less than $20 an hour. Retail workers, for example, saw a 15% increase in hourly wage to $14, but 33% of them – 3.7 million – still fell below the ALICE threshold. The most common occupations for ALICE workers are home health aides, personal care aides, cashiers, waitstaff, fast-food workers and janitors.