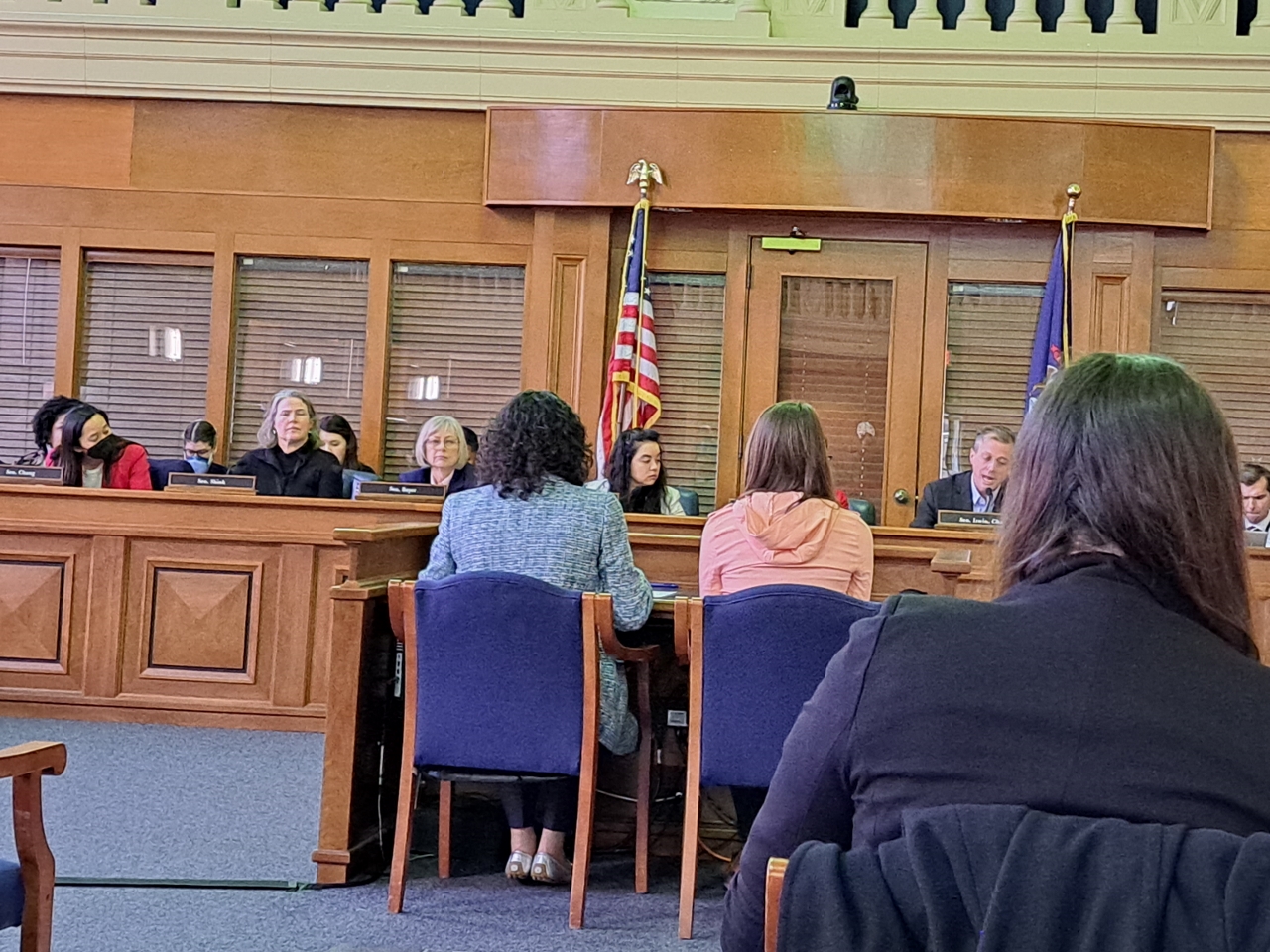

Members of the Michigan Senate’s Housing and Human Services Committee got a real-world look this week at how increasing the Earned Income Tax Credit can help financially struggling households.

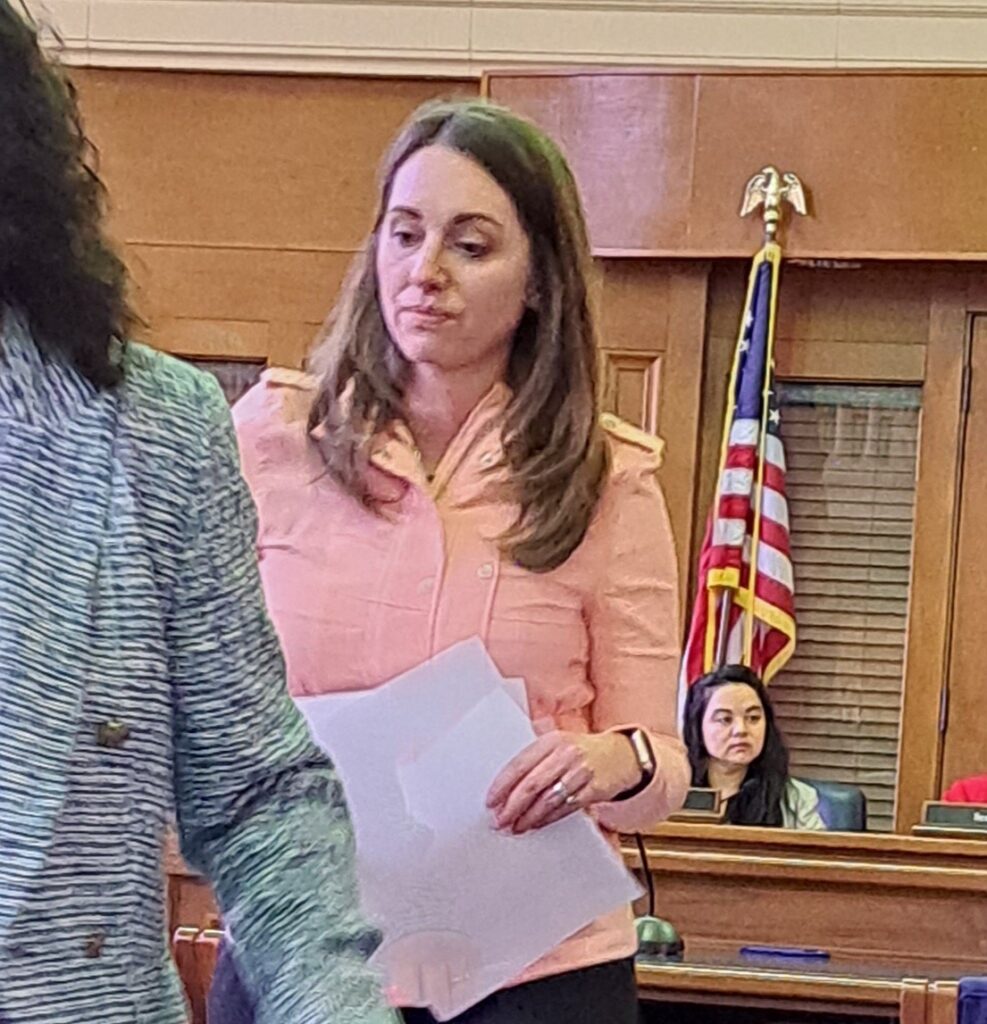

“I first received the Earned Income Tax Credit in 2011. I was a 23-year-old single mom working full time as a lead teacher in a Head Start classroom, making $30,000 a year,” said Bethany Broom-Dombrowski, VITA Community Investment Associate, part of UWSCMI’s Voluntary Income Tax Assistance team. She testified on Jan. 24 before committee members.

“As I was working, my three-year-old daughter attended a local daycare and preschool program, which cost $30 per day and did not include breakfast, lunch or a snack,” she added. Her federal and state EITC refund that year covered about five weeks of daycare.

“The money I did receive was a huge relief because my take-home pay never seemed like enough,” said Broom-Dombrowski.

“I felt like I was on a never ending marathon, living paycheck to paycheck,” she told lawmakers. “Trying to achieve financial stability can be exhausting and it trickles down to children.”

EITC Explained

The EITC is a refundable tax credit available to low- and moderate-income families. Most fall below the ALICE (Asset Limited, Income Constrained, Employed) threshold, a measure of financial hardship.

Currently set at 6% of the federal Earned Income Tax Credit, the state’s EITC would rise to 30% under Senate Bill 3 and apply retroactively to the 2022 tax year. That means qualified taxpayers would start getting the added relief when they file their returns this year.

“What working families need most is more money in their pockets, and they need that right now. This bill would deliver an urgent and essential tax cut for Michigan workers hit hardest by inflation,” said Sen. Kristen McDonald Rivet (D-Bay City), who sponsored Senate Bill 3.

The Council of Michigan Foundations estimates that raising the state EITC would lift more families out of poverty while adding about $553 million to local economies.

More than 250 nonprofits and service organizations, including a huge contingent of United Way’s Michigan network, added their voices to Broom-Dombrowski’s in urging the state Legislature to raise the EITC.

Hard-Working People

Testimony like Broom-Dombrowski’s made these facts and figures real.

“The people earning this credit are hard-working, often working two or more jobs to support their families,” she said. “They simply don’t make enough money to address unexpected mishaps in life, like vehicles breaking down, work hours being cut, or an unexpected medical bill.

“The resources provided by tax credits like the EIC help insulate these families from mishaps, preventing them from upending their already precarious situation,” she added.

Broom-Dombrowski’s full testimony is available here.

At the end of the hearing, the committee members voted to advance the bill to the full Senate. If approved there, it will be sent to the state House of Representatives for consideration.

For more on Senate Bill 3 and Tuesday’s hearing, read this report from MLive. You can learn more about ALICE on UWSCMI’s Meet ALICE web page.