Battle Creek/Kalamazoo

The Kalamazoo Small Business Loan Fund is currently inactive. If you have a small business funding need, please review our Kalamazoo Micro-Enterprise Grant Fund page unitedforscmi.org/battle-creek-kalamazoo/kalamazoo-micro-enterprise-grants/ for more information on our microgrants

About the fund

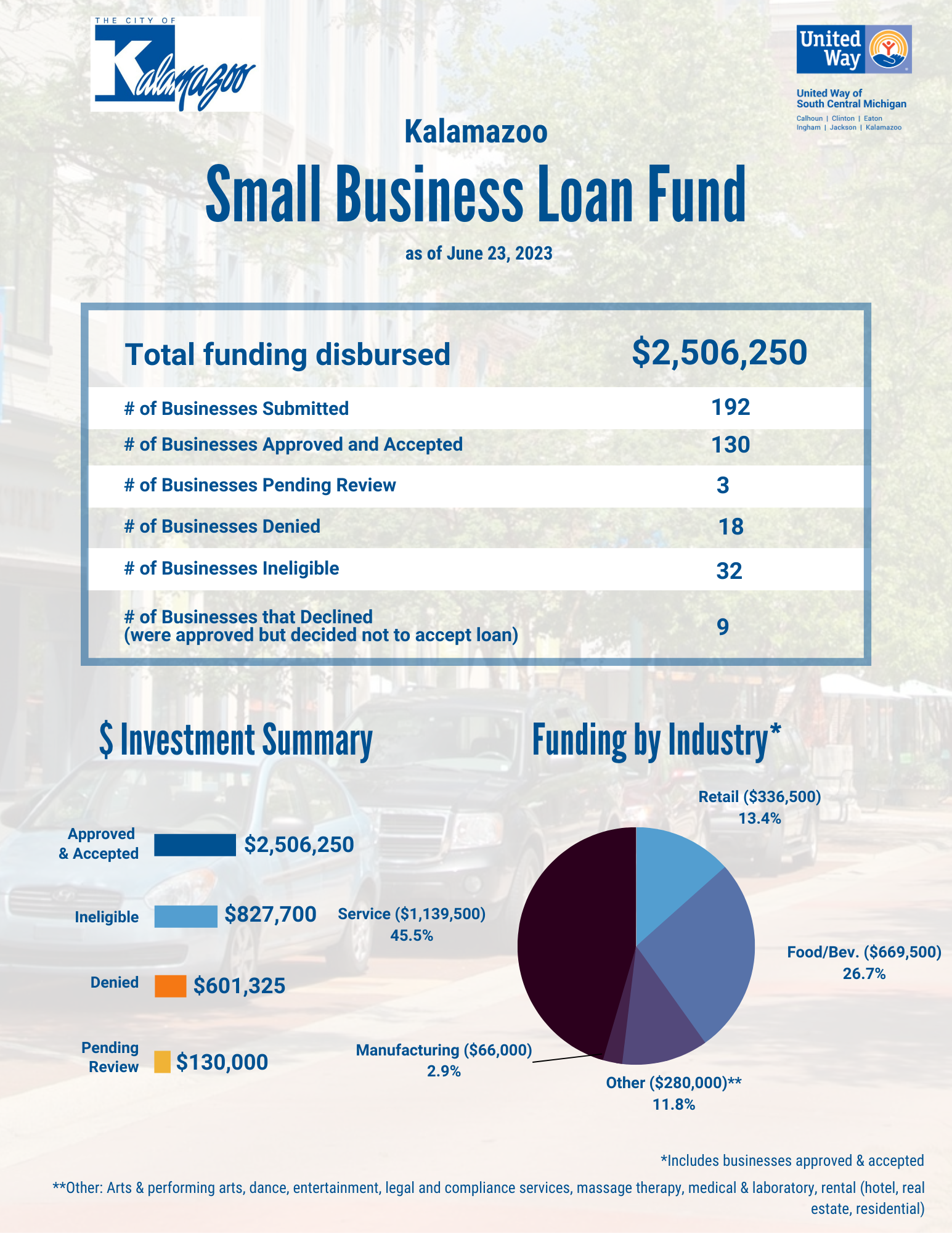

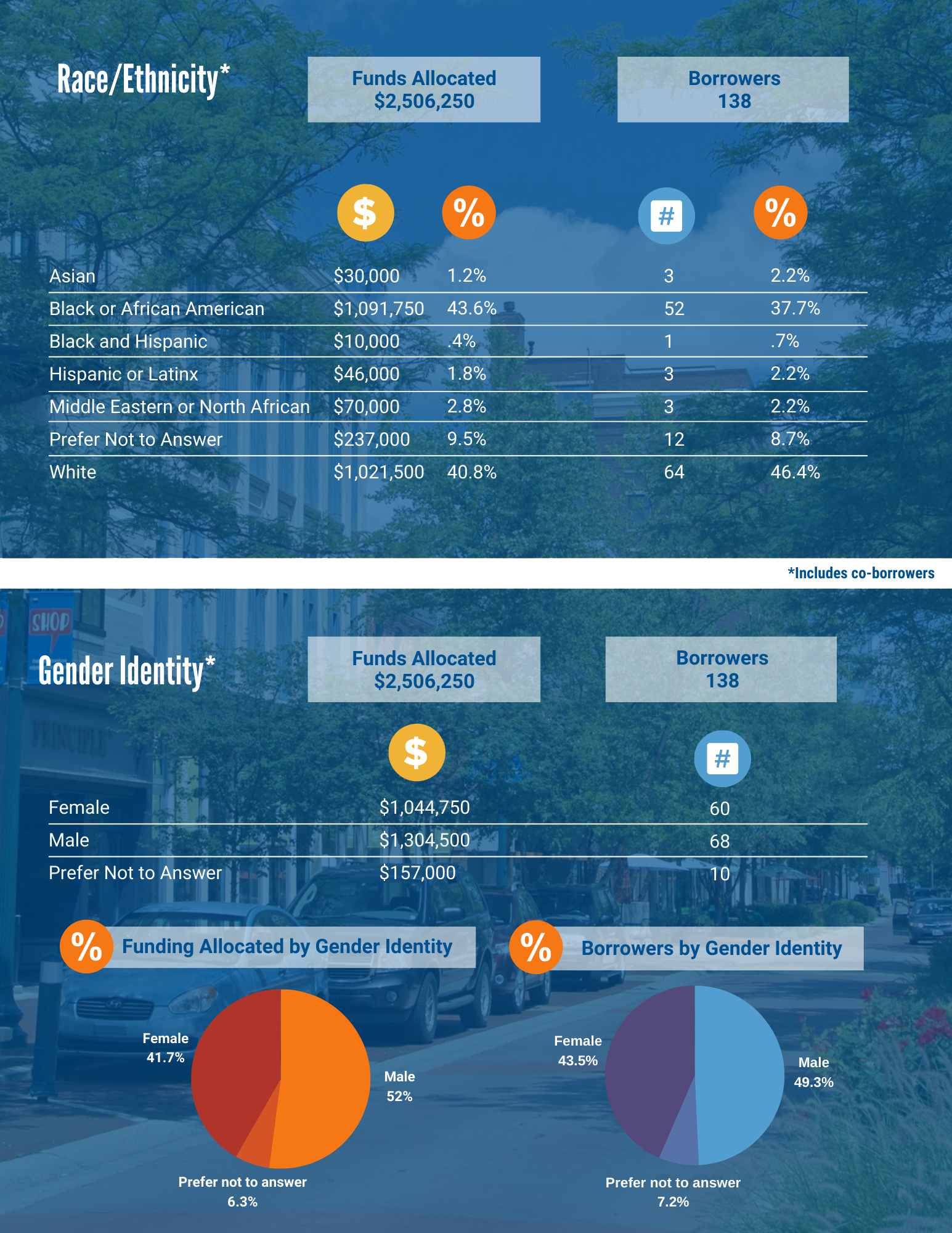

United Way of South Central Michigan has long invested in critical basic needs services and infrastructure across the region. We partner with businesses and their employees year-round to tackle our community’s toughest issues, including how we best support our growing ALICE population (Asset Limited, Income Constrained, Employed). The Kalamazoo Small Business Loan Fund was started as a bridge loan to provide local businesses time and opportunity to take advantage of SBA Loans, State, and Federal loan assistance programs during the COVID-19 pandemic. Initial funding for the Kalamazoo Small Business Loan Fund (KSBLF) was provided through a partnership with the City of Kalamazoo with support from the Foundation For Excellence. Following a pause in 2023, the KSBLF program reopened in Spring 2024. KSBLF currently operates as a revolving loan fund, where the loan funds repaid are used to replenish the lending pool for the future. This program is focused on increasing access to resources and capacity-building supports with an intentional focus on reducing disparities in communities of color and for women-owned businesses. This program aims to help Kalamazoo business owners make investments that strengthen their sales and financial stability during the 3-year term.

Priorities

- Investments in business operations that demonstrate a clear positive impact on the business, such as increased annual sales or decreased annual expenses

- Business owners in communities that have experienced historic under-investment, especially those located in Shared Prosperity Kalamazoo neighborhoods of Eastside, Edison, and Northside

- Owners who identify as Black, Indigenous, and all People of color, as well as women and LGBTQIA+ owners, and those living in an ALICE household

Operational costs such as rent, payroll, and utilities are eligible expenses, but not prioritized, as covering these costs generally does not have a clear long-term positive impact on the business.

Contact

Please contact UWSCMI staff for more information and assistance with your application.

Email: smallbusiness@uwscmi.org